What to Do after a Car Accident: A Step-by-Step Insurance Claim Guide

June 19, 2025

June 19, 2025

Car accidents are stressful and scary, even if they’re just a minor one. But staying calm and knowing what to do right after an accident can save you time, money, and trouble, especially when it comes to making an insurance claim.

Here’s your simple step-by-step guide to handling the situation smoothly and getting your claim processed without any delay.

Step 1: Check for Injuries and Ensure Safety

Check for injuries on both you and the passengers before proceeding. If anyone is hurt, please call emergency services immediately. Your health and safety come first.

Pro Tip: Turn on your hazard lights and, if it’s safe, move your vehicle to the side of the road to avoid further accidents.

Step 2: Call the Police and File an FIR

It’s a good idea to call the police, even for small accidents. When making an insurance claim, particularly in Pakistan, a First Information Report (FIR) may be essential.

Having official documentation helps support your claim and avoids any legal complications.

Step 3: Exchange Information with the Other Driver

Make sure to get the following details from the other party:

- Full name and contact number

- Vehicle registration number

- CNIC copy (if possible)

- Insurance company details

This information will be needed for the car insurance claim process.

Step 4: Take Photos and Document Everything

Click clear pictures of:

- All vehicles involved

- Damage from different angles

- License plates

- Road conditions or traffic signs

These images act as strong proof for your insurance provider.

Step 5: Notify Your Insurance Company

As soon as the accident occurs, give your insurance company a call. If you’re insured with United Insurance Company, their helpline and claim team will guide you step by step.

How United Insurance Company Makes It Easier:

- 24/7 helpline

- Fast claim processing

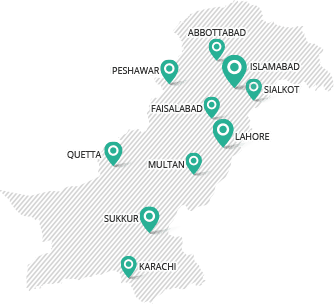

- On-ground assistance in major cities

Step 6: Submit Required Documents

Every insurance provider requires different documents, but generally, you’ll need:

- Filled claim form

- FIR copy

- CNIC copy

- Driving license copy

- Pictures of the accident

- Repair estimates (from approved workshops)

Verify that all of your documentation is complete to prevent delays.

Step 7: Vehicle Inspection & Claim Approval

Once your documents are submitted, an insurance surveyor will inspect the damage. After approval, you can proceed with repairs at a panel workshop or receive reimbursement under the policy terms.

Step 8: Keep Track of Your Claim Status

Stay in touch with your insurance company or check claim status online if available. United Insurance Company offers customer support to keep you updated throughout the process.

Easy Car Insurance Process

Accidents can happen to anyone, but knowing what to do immediately after can help you handle the situation with confidence. With proper documentation and timely action, your car insurance claim can be a smooth process.

If you’re insured with United Insurance Company, you’re already one step ahead, thanks to their trusted support and efficient claims service.