Travel Insurance Benefits: Complete Guide for Pakistani Travelers

August 11, 2025

August 11, 2025

Travel opens up new opportunities from exploring new destinations to expanding your business globally. But along with the excitement comes uncertainty. A sudden illness, a lost passport, or a missed flight can turn a dream trip into a nightmare. That’s why Travel Insurance is a must-have for any traveler.

In this article, we’ll explore Travel Insurance Benefits in detail, backed by the comprehensive plans offered by United Insurance for Travel Insurance in Pakistan. Whether you’re traveling to the Schengen region, exploring the rest of the world, or need special long-term coverage, United Insurance has a plan for you.

1. Why Travel Insurance is Essential

Without travel insurance, you’re financially exposed to unexpected expenses like:

- High medical bills abroad

- Emergency evacuation costs

- Trip delays and cancellations

- Lost or stolen baggage

- Accidental injuries

With United Insurance’s Travel Insurance in Pakistan, you can choose from flexible coverage options to fit your travel needs from short trips to extended stays, and from regional to worldwide protection.

2. Key Travel Insurance Benefits

2.1 Medical Expenses & Hospitalization Abroad

Healthcare costs overseas can be extremely expensive. United Insurance offers robust coverage:

- Schengen Plans: $50,000 medical coverage for Diamond & Gold (excess $50)

- Rest of the World: $25,000 (Silver) or $10,000 (Standard)

- Worldwide: $100,000 (Platinum) or $50,000 (Gold Plus)

- Sapphire Plans: $50,000 (Sapphire) or $100,000 (Sapphire Plus) for long-term travelers

2.2 Emergency Transport & Repatriation

If you suffer a serious illness or accident abroad, actual expenses for:

- Medical evacuation back to Pakistan

- Repatriation of mortal remains

- Travel for one immediate family member in emergencies

are covered in most plans.

2.3 Dental Care

Dental issues abroad can be costly. United Insurance offers:

- $600 coverage for most Schengen/Worldwide plans

- $1,000 for Sapphire and Sapphire Plus

2.4 Travel Delay, Loss, and Theft Coverage

Coverage includes:

- Delayed departure: $200 – $1,000 depending on plan

- Loss of checked baggage: $300 – $1,000

- Loss of passport: $300 (Sapphire plans)

- Loss of credit card (select plans)

2.5 Accidental Death & Disability

Financial protection for your family in case of travel-related accidental death or permanent disability:

- 100% of principal sum insured in Sapphire plans

- Fixed amounts in other packages (e.g., $25,000 in Worldwide Platinum)

2.6 24/7 Travel Assistance

United Insurance provides:

- Urgent message relay (unlimited)

- Long-distance medical information

- Medical referrals and appointments abroad

- Embassy and consulate assistance

3. United Insurance Travel Insurance Plans

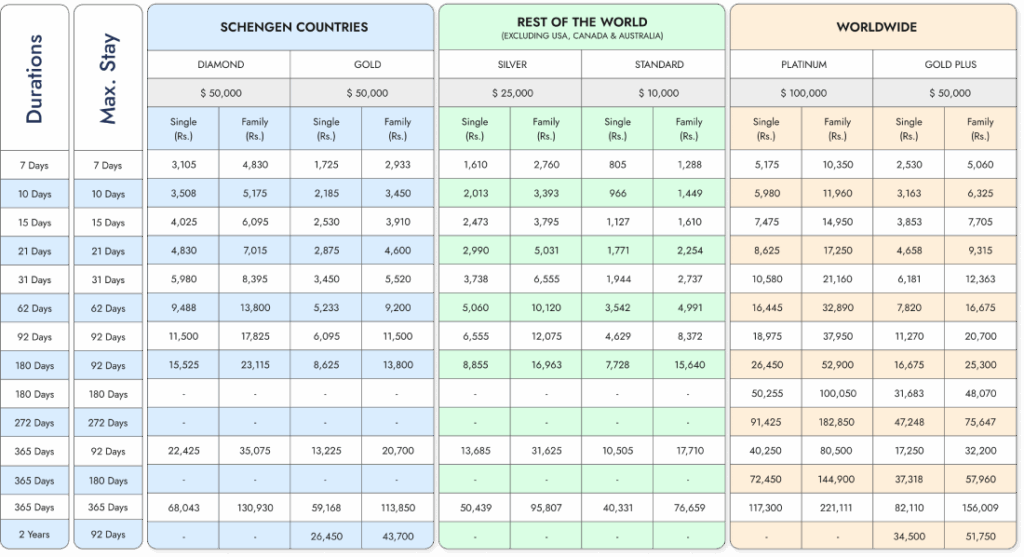

3.1 Schengen Countries Coverage

Ideal for visa requirements and travel to Europe.

- Diamond: $50,000 coverage, Rs. 3,105 (7 days single)

- Gold: $50,000 coverage, Rs. 1,725 (7 days single)

3.2 Rest of the World (Excluding USA, Canada, Australia)

Affordable coverage for Asia, Africa, and select destinations.

- Silver: $25,000 coverage, Rs. 1,610 (7 days single)

- Standard: $10,000 coverage, Rs. 805 (7 days single)

3.3 Worldwide Plans

High-coverage protection for global travel.

- Platinum: $100,000 coverage, Rs. 5,175 (7 days single)

- Gold Plus: $50,000 coverage, Rs. 2,530 (7 days single)

3.4 Sapphire & Sapphire Plus Long-Term Plans

Perfect for students travel insurance, expatriates, and long-term travelers.

| Schedule of Benefits | Sapphire | Sapphire Plus |

|---|---|---|

| Medical Expenses for Sickness & Hospitalization Abroad | $50,000 (Excess $125) | $100,000 (Excess $150) |

| Emergency Dental Care | $1,000 | $1,000 |

| Travel of One Immediate Family Member | $5,000 | $5,000 |

| Repatriation of Mortal Remains | Actual Expenses | Actual Expenses |

| Transport or Repatriation in case of Illness or Accident | Actual Expenses | Actual Expenses |

| Loss of Passport | $300 | $300 |

| In-Flight Loss of Checked-in Baggage | $500 | $500 |

| Accidental Death | 100% of Principal Sum Insured | 100% of Principal Sum Insured |

| Permanent Total Disability | 100% of Principal Sum Insured | 100% of Principal Sum Insured |

Premiums (Single):

- 180 Days: Rs. 14,950 (Sapphire) / Rs. 20,125 (Sapphire Plus)

- 365 Days: Rs. 21,850 (Sapphire) / Rs. 29,325 (Sapphire Plus)

- 24 Months: Rs. 42,550 (Sapphire) / Rs. 56,925 (Sapphire Plus)

4. Choosing the Right Plan

When selecting a plan, consider:

- Destination: Schengen, Worldwide, or regional

- Trip Duration: Short-term vs. long-term

- Coverage Needs: Higher medical limits, baggage protection, family travel benefits

- Budget: Find a balance between affordability and comprehensive coverage

5. Why Choose United Insurance for Travel Insurance in Pakistan?

United Insurance stands out for:

- Multiple coverage options for different destinations

- Affordable rates for both short and long trips

- High medical and travel protection limits

- 24/7 emergency assistance worldwide

- A smooth, customer-friendly claims process

Conclusion

Whether you’re traveling for a week or two years, the Travel Insurance Benefits from United Insurance offer peace of mind, financial protection, and global assistance. With packages ranging from affordable Schengen plans to comprehensive Sapphire Plus coverage, you’ll find the perfect protection for your journey.

Before your next trip, make travel insurance a priority because while trips may be temporary, the peace of mind it offers is priceless.

Frequently Asked Questions

1. What is travel insurance and why do I need it?

Travel insurance is a safety net that protects you from unexpected expenses during your trip, such as medical emergencies, lost baggage, flight delays, or trip cancellations. It’s especially important for international travel where healthcare costs can be very high.

2. Does travel insurance cover medical expenses abroad?

Yes. United Insurance’s Travel Insurance in Pakistan plans offer medical coverage ranging from $10,000 to $100,000 depending on the plan you choose. The Sapphire Plus plan offers the highest coverage for long-term travelers.

3. Is travel insurance mandatory for visiting Schengen countries?

Yes. If you are applying for a Schengen visa, you must have a travel insurance policy with a minimum of €30,000 medical coverage. United Insurance offers Schengen-compliant plans starting from just Rs. 1,725 for 7 days.

4. What is the difference between Sapphire and Sapphire Plus plans?

The main difference is the medical coverage limit:

- Sapphire: $50,000 coverage, excess $125

- Sapphire Plus: $100,000 coverage, excess $150

Both plans cover emergency dental care, repatriation, baggage loss, and accidental death benefits.

5. Does travel insurance cover COVID-19 treatment?

Yes, most current United Insurance travel plans include COVID-19-related medical expenses as part of the medical coverage, subject to policy terms and conditions. Always confirm the latest coverage before purchasing.

6. Can I buy travel insurance for long-term trips?

Yes. The Sapphire and Sapphire Plus plans cover trips up to 24 months, making them ideal for students, expatriates, and long-term business travelers.

7. How much does travel insurance cost in Pakistan?

The cost depends on the plan, destination, and trip duration. For example:

- Schengen Gold Plan: Rs. 1,725 for 7 days

- Worldwide Platinum Plan: Rs. 5,175 for 7 days

- Sapphire Plus Plan: Rs. 20,125 for 180 days

8. How do I make a claim if something goes wrong during my trip?

Contact United Insurance’s 24/7 assistance hotline immediately. Keep all supporting documents such as medical bills, police reports, or airline letters to process your claim smoothly.

9. Does travel insurance cover lost passports?

Yes. Most plans, including Sapphire and Sapphire Plus, offer coverage for lost passports — up to $300 for replacement costs.

10. How can I purchase travel insurance from United Insurance?

You can buy directly from United Insurance offices, authorized agents, or through our online portal. Make sure to buy it before your departure to ensure full coverage.