Third-Party vs. Comprehensive Motor Insurance: Which One is Right for You?

June 21, 2025

June 21, 2025

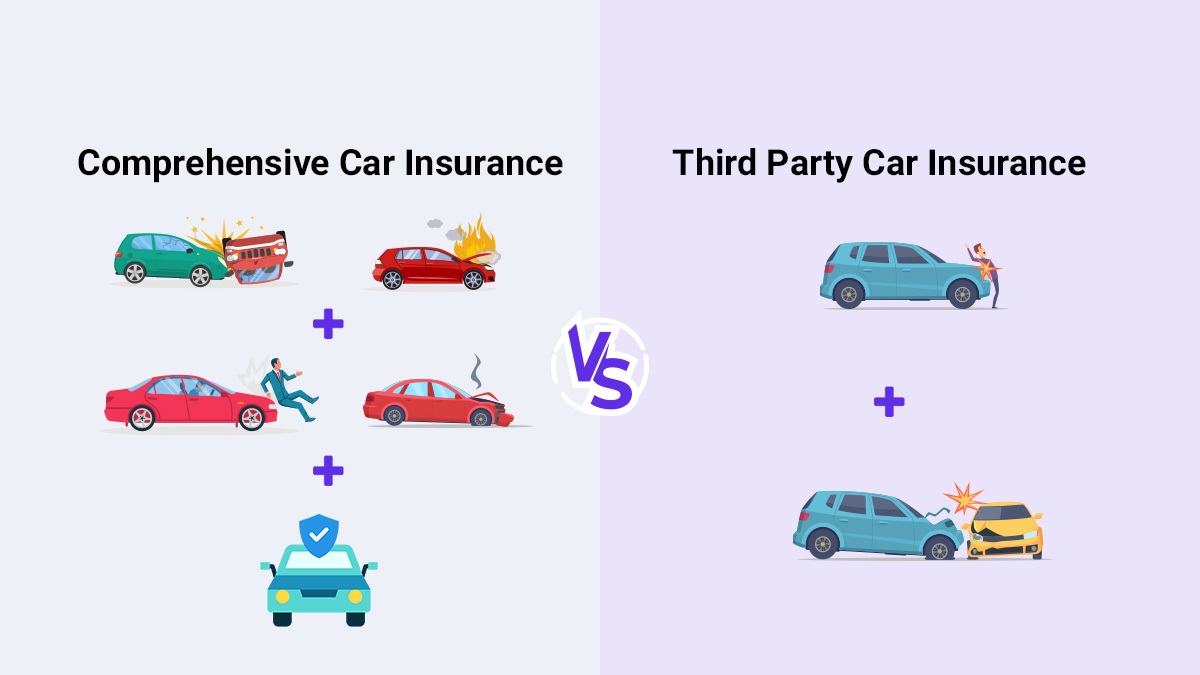

When buying car insurance, one of the biggest decisions you’ll make is choosing between third-party insurance and comprehensive motor insurance. Each type offers different benefits, and the right choice depends on your needs, budget, and driving habits.

Let’s break down the key differences in simple words so that you can make the best decision for your vehicle.

What Is Third-Party Motor Insurance?

Third-party insurance is legally required in Pakistan. It guards against the damage your vehicle causes to other vehicles, people, or property. However, it doesn’t cover any damage to your car.

What Does It Cover?

- Injury or death of a third party

- Damage to third-party property or vehicle

- Legal liabilities from an accident

Pros of Third-Party Insurance

- Cheaper premium rates

- Fulfills legal requirement

- Best for older or low-value vehicles

Cons of Third-Party Insurance

- No coverage for your own vehicle’s damage

- No protection against theft or natural disasters

What Is Comprehensive Motor Insurance?

Comprehensive insurance provides full coverage for both third-party damage and your vehicle, as the name suggests. It covers accidents, theft, fire, natural calamities, and even personal injuries in some cases.

What Does It Cover?

- Damage to your car due to accidents

- Theft, fire, and natural disasters (like floods)

- Third-party liability

- Personal injury coverage (optional)

Pros of Comprehensive Insurance

- Full protection and peace of mind

- Covers accidental, fire, and theft damage

- Valuable for new or expensive vehicles

Cons of Comprehensive Insurance

- Higher premium compared to third-party insurance

- May not be ideal for older vehicles

Key Differences at a Glance

| Feature | Third-Party Insurance | Comprehensive Insurance |

| Covers Own Vehicle | ❌ | ✅ |

| Covers Third-Party Damages | ✅ | ✅ |

| Theft/Natural Disaster Cover | ❌ | ✅ |

| Premium Cost | Low | Higher |

| Legal Requirement | ✅ | ❌ (optional) |

Which Insurance Should You Choose?

Choosing the right motor insurance depends on several factors:

- Your budget: If you’re looking for an affordable option, a third-party is enough.

- Value of your Car: Purchasing comprehensive insurance is worthwhile if your car is brand-new or costly.

- Risk factors: If you drive in a high-traffic area or park on the street, comprehensive coverage gives added protection.

Why Choose United Insurance Company?

If you’re looking for affordable, reliable, and flexible motor insurance plans, United Insurance Company has you covered. Whether you want basic third-party coverage or full comprehensive protection, United Insurance Company offers customized insurance solutions tailored to your needs.

- Easy online quotes

- Quick claim processing

- 24/7 customer support

- Trusted by thousands across Pakistan

Get protected today!

When it comes to protecting your vehicle, knowledge is power. Whether you choose third-party insurance for its affordability or go for the all-inclusive comprehensive coverage, make sure your policy matches your driving lifestyle.

Still unsure? Reach out to United Insurance Company today and let their experts guide you to the perfect plan.