Healthcare needs in Pakistan continue to grow, and so does the demand for easy, affordable, and accessible medical services. While hospitalization coverage is essential, most people visit clinics, doctors, and diagnostic labs far more often than hospitals. These day-to-day medical expenses can become significant if not planned properly. This is where OPD health insurance in Pakistan becomes extremely important.

OPD (Outpatient Department) coverage covers medical expenses that do not require hospitalization. Since a large percentage of medical cases in Pakistan are treated without hospitalization, OPD health insurance in Pakistan has become one of the most practical and in-demand forms of health protection. It helps individuals and employees manage routine medical costs such as doctor consultations, medicines, diagnostic tests, and follow-ups.

In this guide, we will fully explain what OPD health insurance is, how it works in Pakistan, who should get it, why it is becoming popular, and how the United Insurance Company of Pakistan (UIC) provides OPD coverage under its Corporate Health Insurance plans.

What Is OPD Health Insurance in Pakistan?

OPD (Outpatient Department) health insurance provides financial coverage for medical services where hospital admission is not required. Unlike traditional health insurance plans that focus mostly on hospitalization, OPD coverage is used for everyday medical needs.

This includes:

- Doctor consultation fees

- Medicines and prescription costs

- Blood tests, X-rays, and diagnostic scans

- Specialist visits

- Minor medical procedures

- Follow-ups after treatment

- Routine health check-ups

Because these medical expenses occur frequently, OPD health insurance in Pakistan helps individuals and employees reduce the financial burden of routine healthcare. Parent health insurance in Pakistan offers comprehensive medical coverage for your parents, ensuring their healthcare needs are protected with reliable and affordable insurance plans.

Why OPD Health Insurance Is Important in Pakistan

When people think of health insurance, they usually think of major hospitalization expenses. But in reality, most healthcare spending in Pakistan happens on small yet frequent medical needs.

Families and employees in Pakistan face:

- Rising consultation fees

- Expensive medicines

- High diagnostic test costs

- Frequent visits to specialists

- Seasonal diseases

- Long-term medical management

Here is why OPD health insurance in Pakistan is becoming essential:

1. Routine Healthcare Is Expensive

Consultation fees have increased significantly across private hospitals and clinics. OPD insurance reduces these repeated costs.

2. Medicines and Tests Cost More Each Year

Many people cannot afford medicines or lab tests regularly. OPD coverage makes treatments easier to continue.

3. Early Diagnosis Prevents Major Illness

With OPD coverage, people can visit doctors early without worrying about cost.

4. Most Medical Cases in Pakistan Are OPD-Based

Data from private hospitals shows that over 70% of medical treatments are done without hospitalization.

5. Ideal for Families, Corporates, and Organizations

Companies use OPD health insurance in Pakistan to support employee health and improve productivity.

What Does OPD Health Insurance Typically Cover?

Coverage may vary by insurance provider, but most OPD plans cover:

✔ Consultation Fees

Visits to general physicians and specialists.

✔ Diagnostic Tests

Blood tests, X-rays, ultrasound, and other lab investigations.

✔ Prescription Medicines

Coverage for doctor-prescribed medication.

✔ Minor Medical Procedures

Treatment for minor injuries or illnesses that don’t require hospitalization.

✔ Routine Check-ups

Annual or semi-annual preventive check-ups.

✔ Follow-up Care

Follow-up visits after illness or surgery.

This makes OPD health insurance in Pakistan extremely valuable for organizations and families.

OPD Health Insurance in Pakistan for Individuals vs. Corporates

Not all insurance companies in Pakistan offer OPD coverage to individuals, because outpatient costs are more frequent. However, OPD coverage is widely available in corporate health insurance plans.

Individual Plans

Limited insurers provide OPD benefits individually, and these usually come with caps and conditions.

Corporate Plans

This is where OPD coverage is most popular. Companies provide OPD health coverage to employees as part of their HR benefits.

This improves:

- Employee health

- Job satisfaction

- Productivity

- Retention

- Company reputation

Corporate OPD plans cover employees and sometimes their dependents.

OPD Health Insurance in Pakistan by United Insurance Company of Pakistan (UIC)

The United Insurance Company of Pakistan is one of the leading providers of health insurance solutions in the country. UIC offers OPD coverage under Corporate Health Insurance, helping companies support their employees with strong day-to-day medical protection.

UIC’s OPD Coverage Includes:

- Doctor consultation reimbursement

- Prescribed medicines

- Diagnostic tests

- Specialist visits

- Follow-ups

- Preventive care tests

- Minor medical procedures

UIC’s corporate OPD plans are designed for:

- Small companies

- Medium enterprises

- Large organizations

- NGOs

- Schools and colleges

- Industries and factories

- Corporate groups

UIC ensures easy claim submission, fast processing, and a smooth experience for employees.

How OPD Health Insurance Works in Pakistan

The process is simple, especially with corporate plans.

Step 1: Visit Your Doctor

Choose any registered doctor or clinic.

Step 2: Pay the Fee

You pay directly at the clinic or pharmacy.

Step 3: Keep Receipts

Save your medical bills and prescriptions.

Step 4: Submit Claim

Submit documents to your corporate HR or directly to UIC (based on company policy).

Step 5: Claim Reimbursement

UIC reimburses your approved OPD bills as per your coverage limit.

The system is efficient, simple, and employee-friendly.

Who Should Get OPD Health Insurance in Pakistan?

OPD coverage is beneficial for:

1. Corporate Employees

Daily healthcare support greatly benefits employees who frequently visit doctors.

2. Families

Children and elderly family members usually need regular check-ups.

3. Organizations Looking to Offer Employee Benefits

Companies providing OPD support see increased employee loyalty.

4. Individuals with Chronic Conditions

Patients with diabetes, hypertension, asthma, and other chronic conditions often require OPD visits.

5. Businesses That Want to Improve Workforce Efficiency

Healthy employees mean better productivity and fewer absences.

Why OPD Health Insurance Is Becoming Popular in Pakistan

There is a clear shift in the insurance industry, and more companies are asking for OPD coverage.

Reasons include:

- Increased awareness

- Rise in consultation fees

- Higher medical inflation

- Greater need for preventive healthcare

- Corporate sector growth

- Employee wellbeing programs

This is why OPD health insurance in Pakistan is now considered a core part of modern corporate benefits.

Benefits of OPD Health Insurance in Pakistan

✔ Saves money on routine healthcare

✔ Encourages early treatment

✔ Reduces burden of medical inflation

✔ Improves employee satisfaction and retention

✔ Supports preventive healthcare

✔ Helps manage chronic diseases

✔ Enhances organizational healthcare benefits

Challenges in OPD Health Insurance in Pakistan

Although it has many advantages, OPD insurance also comes with challenges:

- High frequency of claims

- Misuse of OPD benefits

- Limited availability for individuals

- Strict documentation requirements

Despite these challenges, corporate OPD plans continue to grow rapidly.

Why UIC Is a Trusted Name for OPD Health Insurance in Pakistan

UIC is known for:

- Fast claim settlement

- Affordable corporate health plans

- Flexible OPD coverage

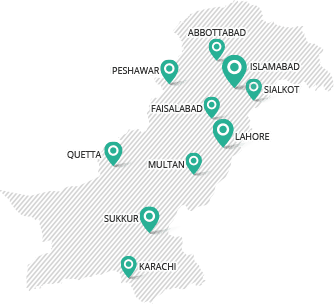

- Nationwide service

- Decades of experience in health insurance

- Smooth claim processing system

Companies across Pakistan rely on UIC for comprehensive corporate health insurance, including OPD benefits.

Why Choose This Plan?

- AA+ rated insurance provider

- More than 65 years of trusted experience

- Access to Pakistan-wide OPD partner hospitals

- Fast and convenient claim handling

Conclusion

OPD health insurance in Pakistan has become a vital part of healthcare planning, especially for organizations and employees. With rising medical costs, OPD coverage helps people manage routine healthcare expenses like consultations, medicines, and diagnostics.

For companies looking to support their employees with complete medical protection, the United Insurance Company of Pakistan (UIC) offers reliable Corporate Health Insurance with OPD coverage, making it one of the top choices in Pakistan.