In recent years, the cost of healthcare in Pakistan has been rising at a pace that puts families under immense financial pressure. A single hospital visit, surgery, or medical emergency can drain years of savings. This is where Health Insurance becomes not just an option, but a necessity. By providing financial support during medical crises, health insurance ensures that families can access quality healthcare without the constant fear of overwhelming medical bills.

At United Insurance Company of Pakistan (UIC), we understand this challenge and have designed affordable and comprehensive health insurance plans for individuals and families. Our product, Family Health Secure, is built to provide maximum protection, convenience, and peace of mind.

Why Health Insurance is Essential for Pakistani Families

Healthcare costs in Pakistan are on the rise due to advanced medical technology, expensive diagnostic procedures, and the growing burden of diseases. Families without health coverage often face two difficult choices: compromise on the quality of healthcare or take on financial debts to manage medical treatment.

Here’s why Health Insurance is a vital safety net for every family in Pakistan:

Protection Against Uncertainty

Illness, accidents, and medical emergencies come without warning. Health insurance ensures that you and your family are financially secure during such unforeseen circumstances.

Affordable Access to Quality Care

With a reliable insurance plan, you can afford hospitalization, surgeries, and advanced treatments that would otherwise be financially out of reach.

Peace of MindHow Health Insurance Protects Pakistani Families from Rising Medical Costs

Knowing that medical expenses are covered allows families to focus on recovery and well-being instead of worrying about bills.

Financial Stability

Health insurance protects savings and assets from being consumed by unexpected medical costs.

United Insurance – Family Health Secure Plan

United Insurance is proud to introduce Family Health Secure, a specialized Health Insurance product tailored for individuals and families in Pakistan. It offers coverage for hospitalization expenses, surgeries, and additional benefits that ensure financial safety.

Key Features of Family Health Secure

-

Coverage Options: Choose from three plans – Rose, Tulip, and Jasmin – based on affordability and healthcare needs.

-

Room Entitlement: Hospital room and board charges are covered with corresponding annual limits.

-

ICU Coverage: Maximum ICU coverage for days of hospitalization.

-

Pre & Post Hospitalization: Coverage includes expenses before and after hospital admission (up to 30 days).

-

Ambulance Services: Transportation for emergencies is included.

-

Accidental Coverage: Expenses for emergency treatments due to accidents.

Coverage Amounts

-

Rose Plan: Up to Rs. 250,000 annually

-

Tulip Plan: Up to Rs. 350,000 annually

-

Jasmin Plan: Up to Rs. 500,000 annually

These options allow families to select a plan that matches their financial capacity and healthcare requirements.

Benefits of Health Insurance with United Insurance

Choosing United Insurance for your family’s Health Insurance means enjoying multiple benefits that go beyond just hospitalization coverage.

1. Inpatient Hospitalization Coverage

All major hospitalization expenses are covered, including:

-

Room & board charges

-

Surgical procedures

-

Physician & specialist fees

-

Diagnostic services

-

Blood and oxygen supplies

-

Chemotherapy, kidney dialysis, and radiotherapy

2. Day Care Treatments

Besides standard hospitalization, Family Health Secure also covers medical procedures that do not require overnight stays, such as minor surgeries and diagnostic treatments.

3. Pre & Post-Hospitalization Expenses

Medical treatment before and after hospitalization, including diagnostic tests, consultations, and follow-ups, are covered.

4. Ambulance Services

Emergency transportation to the hospital ensures timely care during critical moments.

5. 24/7 Medical Assistance

Our helpline provides round-the-clock support for medical emergencies and quick guidance from professionals.

Who Can Apply for Health Insurance?

With United Insurance, the process of applying for Conventional Health Insurance is simple and inclusive.

-

Age eligibility: 18–65 years for adults.

-

Dependent children: 3 months–18 years (extendable to 25 years if dependent).

-

Self, spouse, children, and parents are eligible for coverage.

What is Not Covered?

Like all insurance plans, certain exclusions apply:

-

Pre-existing conditions and chronic illnesses.

-

Congenital defects or birth disorders.

-

Psychiatric or mental disorders.

-

Expenses for drug/alcohol abuse or injuries due to risky behavior.

United Insurance ensures transparency by clearly defining exclusions so customers can make informed choices.

Why Choose United Insurance for Health Insurance?

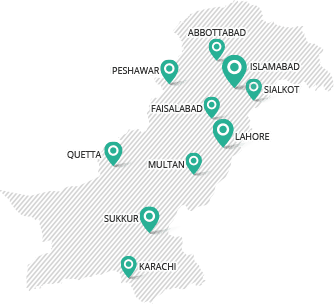

Established in 1959, United Insurance Company of Pakistan has been one of the most trusted insurance providers in the region. With its extensive branch network and reputation for financial strength, UIC continues to deliver reliable and customer-friendly insurance services.

Here’s what makes us different:

-

Affordable Plans: Flexible coverage options designed for every budget.

-

Nationwide Network: Access to panel hospitals across Pakistan for cashless treatments.

-

Customer Service: Quick, responsive, and helpful support team.

-

No-Claim Bonus: If no claim is filed in the first two years, the coverage limit increases by 15%.

-

Easy Payments: Premiums can be paid through banks, cards, or cash.

Protect Your Family Today

Medical emergencies can strike at any moment, leaving families emotionally and financially vulnerable. By securing your loved ones with Health Insurance, you are not only protecting your finances but also ensuring access to quality medical care whenever needed.

United Insurance’s Family Health Secure plan is the answer to rising healthcare costs in Pakistan. It empowers families to focus on recovery, health, and happiness without worrying about hospital bills.

Final Thoughts

In Pakistan, where medical expenses are rapidly increasing, Health Insurance is no longer a luxury—it is a necessity. Families must safeguard their health and finances with a reliable insurance provider.

At United Insurance, we are committed to delivering affordable, comprehensive, and customer-focused insurance solutions. With Family Health Secure, you can rest assured that your family’s well-being is in safe hands.

Don’t wait for a medical emergency to disrupt your financial stability. Secure your family today with United Insurance – Family Health Secure Plan.