In today’s fast-moving world, healthcare has become more expensive than ever. A single medical emergency can drain years of savings and put families under severe financial stress. This is why Family Medical Insurance Plans are essential for every household in Pakistan. These plans ensure that you and your loved ones get timely medical support without worrying about hospital bills.

Among many insurance providers, The United Insurance Company of Pakistan (UIC) stands out with its strong financial strength, nationwide network, and affordable health insurance options. Established in 1959, UIC is rated “AA+” by PACRA, making it one of the most reliable names in Pakistan’s insurance industry. Their Family Health Secure Plan is specially designed to provide accessible, budget-friendly, and high-quality medical protection for families.

In this comprehensive guide, we explore what Family Medical Insurance Plans are, why they are important, and how UIC’s Family Health Secure Plan offers complete coverage for every family in Pakistan.

What Are Family Medical Insurance Plans?

A Family Medical Insurance Plan is a health protection policy that covers medical expenses for you and your dependents under a single plan. Instead of buying individual policies for every family member, a family plan offers combined coverage, ensuring financial support during hospitalization, surgeries, diagnostic tests, and emergencies.

These plans are ideal for families that want comprehensive health coverage at an affordable cost.

Why Family Medical Insurance Plans Are Essential in Pakistan

Healthcare challenges are increasing across Pakistan—rising medical bills, high consultation fees, and inflation are pushing healthcare beyond the reach of many families. A sudden illness or accident can disturb financial stability, causing emotional and financial stress.

Here’s why Family Medical Insurance Plans are a necessity:

1. Protection from Rising Medical Costs

Hospitalization, surgeries, and diagnostic tests can cost thousands of rupees. A family insurance plan ensures these costs are covered without affecting your savings.

2. Cashless Treatment Facility

Most insurance companies now offer cashless hospitalization, meaning you don’t need to pay upfront at a panel hospital. UIC’s Family Health Secure Plan provides a complete credit facility at over 100+ panel hospitals across Pakistan.

3. Peace of Mind in Emergencies

Health emergencies happen without warning. With an active family medical insurance plan, you know medical support is always available.

4. Coverage for All Dependents

Plans cover not just you, but your spouse, children, and even dependent parents—making it ideal for joint families.

5. Financial Security for the Entire Family

A good insurance plan ensures that financial stress is never a barrier to receiving high-quality healthcare.

Family Health Secure Plan by The United Insurance Company of Pakistan

The Family Health Secure Plan by UIC is one of the most comprehensive and affordable family medical insurance plans in Pakistan. It is designed to provide complete medical coverage to families who may not have any employer-sponsored health benefits.

UIC offers three plan options under Family Health Secure:

- Rose

- Tulip

- Jasmine

Each plan has different annual limits, room entitlements, and premium categories, allowing families to choose a package that suits their budget.

Key Benefits of UIC Family Health Secure Plan

1. In-Patient Hospitalization Coverage

The plan covers hospitalization expenses such as:

- Surgeon fees

- Operating theater charges

- Anesthetist’s fee

- Medicines used during hospitalization

- Laboratory tests

- Ventilator and ICU care

- Blood transfusions

- Kidney dialysis

- Chemotherapy and radiotherapy

This ensures that all major treatment expenses are taken care of.

2. Room Entitlement

According to the chosen plan (Rose, Tulip, or Jasmine), customers receive room and board entitlement without financial stress.

3. Pre & Post Hospitalization Coverage

The plan covers:

- Consultation charges

- Diagnostic tests

- Medications

for 30 days before hospitalization and 30 days after discharge, offering complete medical protection.

4. Day Care Procedures

Many medical treatments no longer require overnight hospital stays. Family Health Secure covers these day care treatments such as minor surgeries and diagnostic procedures.

5. Specialized Diagnostic Coverage

UIC covers expensive diagnostic tests like:

- MRI

- CT Scan

- Angiography

- Mammography

- Thallium scan

These tests are covered without the requirement of hospitalization.

6. Ambulance Coverage

Emergency ambulance services are covered to ensure safe transportation of patients during emergencies.

7. Emergency Accident Benefits

In case of accidental injuries, emergency treatment within 48 hours of the accident is covered under the plan.

8. No Claim Bonus

If no claim is made for two consecutive policy years, the annual limit is increased by 15%, rewarding families for maintaining good health.

Who Can Apply for the Family Health Secure Plan?

Eligibility criteria include:

- Pakistani residents between 18 to 64 years

- Dependent children aged 3 months to 25 years

- Dependent parents can also be included

- Unmarried daughters have no age limit

This plan is ideal for both small and joint families.

Is Pre-Acceptance Medical Checkup Required?

- Individuals over 40 years may need a medical test before approval.

- UIC reserves the right to request medical tests regardless of age.

Are Pre-Existing Conditions Covered?

Pre-existing medical conditions are not covered under this plan. Any illness or injury before policy issuance is considered pre-existing.

How to Pay the Premium?

- Premium is paid annually in advance

- Accepted modes: cross cheque, pay order, or bank draft

- No cash is accepted

UIC’s Added Advantages and Customer Support

24-Hour Medical Hotline

Customers get round-the-clock access to qualified doctors during emergencies.

Customer Service Support

UIC provides dedicated customer relationship officers to assist with claims, queries, and facilitation.

Health Card Facility

Each insured member receives a health card that allows cashless treatment at UIC’s panel hospitals.

What Is Not Covered? (Key Exclusions)

The plan does NOT cover:

- Pre-existing diseases

- Birth defects

- Psychiatric or mental disorders

- Cosmetic or aesthetic treatments

- Illness due to drug or alcohol use

- Treatment in a room category higher than entitlement

- Pregnancy-related treatments

For full exclusions, UIC policy documents should be reviewed.

Why Choose The United Insurance Company of Pakistan?

- Rated “AA+” by PACRA

- Operating since 1959

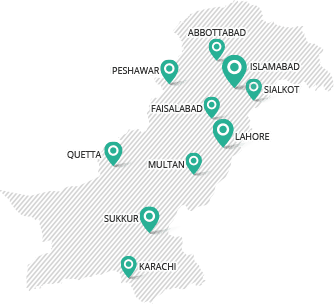

- Large network of branches nationwide

- More than 100+ panel hospitals

- Affordable premiums for all income groups

- Strong claim support and customer assistance

- Transparent and dependable service

UIC’s Family Health Secure is designed to make quality healthcare accessible for every family.

Conclusion

A Family Medical Insurance Plan is not just a policy—it is an essential financial shield for your loved ones. With rising medical costs in Pakistan, securing your family’s health should be a top priority. The Family Health Secure Plan by The United Insurance Company of Pakistan offers comprehensive coverage, affordability, cashless hospitalization, and a wide hospital network to support families during medical emergencies.

If you want complete peace of mind, reliable financial protection, and quality healthcare access, choosing UIC’s Family Health Secure Plan is one of the best decisions you can make for your family. Protect your loved ones — Get a Quote for Family Medical Insurance Plans now.