Traveling abroad is exciting, but when applying for visas to destinations like the USA or Ireland, securing travel insurance is often a crucial requirement. Many travelers are confused about why insurance is necessary, what it covers, and how much it costs. In this blog, we’ll break down the most frequently asked questions (FAQs) about travel insurance for the USA and Ireland visa applications, focusing on requirements, coverage, process, and benefits.

1. Is travel insurance mandatory for USA and Ireland visa applications?

- USA Visa: Travel insurance is not a mandatory requirement for the USA visa application. However, it is highly recommended since healthcare costs in the USA are extremely high. Without coverage, even a minor medical issue can lead to thousands of dollars in expenses.

- Ireland Visa: Travel insurance is mandatory for Ireland visa applications. Applicants must provide proof of valid insurance that covers medical expenses and repatriation for at least €30,000.

2. What is covered under travel insurance for USA & Ireland?

Most travel insurance plans include the following benefits:

- Medical Expenses & Hospitalization Abroad

- Transport or Repatriation in case of illness or accident

- Repatriation of mortal remains

- Emergency dental care

- Loss of baggage or delayed departure

- Accidental death coverage

Some premium plans may also include:

- Delivery of medicines

- Relay of urgent messages

- Medical referral/appointment with a local specialist

- Loss of credit card assistance

3. How much does travel insurance cost for USA and Ireland?

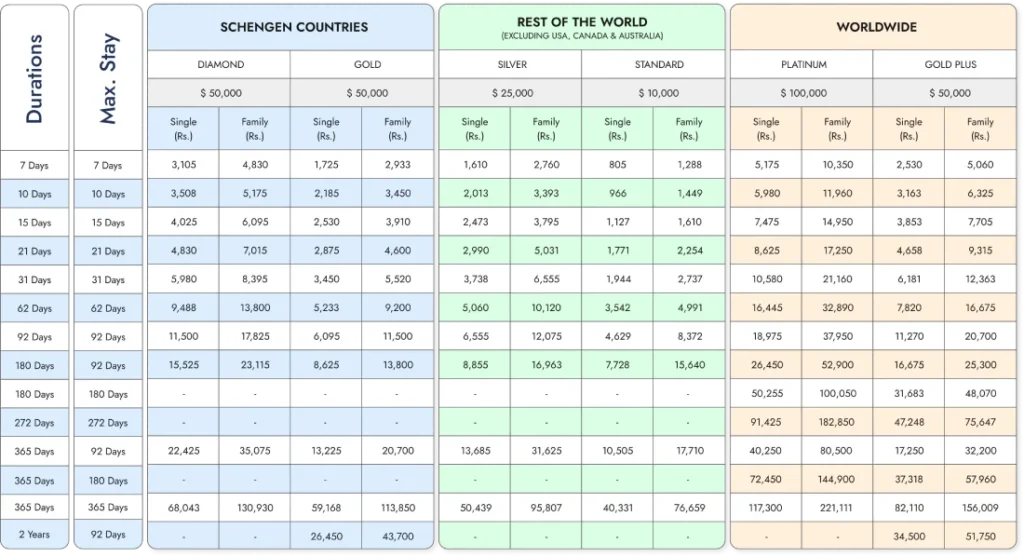

The cost of travel insurance depends on the destination, duration of stay, coverage amount, and whether it’s a single or family plan. Based on available plans:

- USA (Worldwide Plans)

- Gold Plus ($50,000 coverage): Around five thousand and sixty rupees for 7 days (family plan ~ ten thousand three hundred and fifty rupees).

- Platinum ($100,000 coverage): Around ten thousand three hundred and fifty rupees for 7 days (family plan ~ twenty-one thousand one hundred and sixty rupees).

- Ireland (Rest of the World Plans)

- Standard ($10,000 coverage): Around eight hundred and five rupees for 7 days (family plan ~ one thousand two hundred and eighty-eight rupees).

- Silver ($25,000 coverage): Around one thousand six hundred and ten rupees for 7 days (family plan ~ two thousand seven hundred and sixty rupees).

These costs increase with longer durations. For example:

- 31 days (USA, Worldwide Platinum): Around ten thousand five hundred and eighty rupees (family plan ~ twenty-one thousand one hundred and sixty rupees).

- 31 days (Ireland, Rest of the World Silver): Around three thousand seven hundred and thirty-eight rupees (family plan ~ six thousand five hundred and fifty-five rupees).

- 92 days (USA, Worldwide Platinum): Around eighteen thousand nine hundred and seventy-five rupees (family plan ~ thirty-seven thousand nine hundred and fifty rupees).

- 92 days (Ireland, Rest of the World Silver): Around six thousand five hundred and fifty-five rupees (family plan ~ twelve thousand and seventy-five rupees).

4. How do I buy travel insurance for USA or Ireland visas?

The process is simple:

- Choose the plan based on your destination and duration (Rest of the World or Worldwide).

- Apply online or through UIC website or UIC Travel Portal.

- Submit required details like passport, travel dates, and personal information.

- Receive your policy certificate – this document is essential for visa applications (Ireland) and highly useful for travel to the USA.

5. What documents are needed for travel insurance?

When applying for travel insurance, you typically need:

- Passport copy

- Visa application details (for Ireland)

- Travel itinerary

- Contact details

6. Why is travel insurance recommended even if not mandatory (like in the USA)?

- Healthcare in the USA is one of the most expensive in the world. For example:

- An emergency room visit can cost over two thousand dollars.

- Hospitalization may cost ten thousand dollars or more per day.

- Without insurance, travelers may face financial hardship.

- Travel insurance provides peace of mind and ensures you’re covered against unexpected emergencies.

7. What are the benefits of travel insurance for USA & Ireland travelers?

- Visa Compliance: Mandatory for Ireland, strongly advised for USA.

- Financial Protection: Avoids massive out-of-pocket expenses.

- Emergency Assistance: Coverage for hospitalization, repatriation, and even urgent family travel.

- Travel Convenience: Compensation for baggage loss, delayed flights, or missed connections.

8. How do I choose the best travel insurance plan?

Consider:

- Destination requirements (Travel Insurance for Ireland Visa requires minimum €30,000 coverage).

- Duration of stay (short visits vs. long-term stays).

- Coverage amount (higher coverage for USA due to high medical costs).

- Family or single plan (depending on who’s traveling).

- Extra benefits like baggage loss, flight delays, and accidental death coverage.

Final Thoughts

Travel insurance is more than just a visa requirement—it’s your safety net abroad. For Ireland visa applications, it is a must-have, while for the USA, it is strongly advised given the high healthcare costs. Whether you choose a Rest of the World Silver Plan for Ireland or a Worldwide Platinum Travel Insurance Plan for the USA, the small cost of insurance can save you from significant financial stress.

Always review your travel insurance policy carefully, understand the coverage, and ensure it meets visa requirements before applying.